Trading charts

Here we share some chart pattern to learn and grow your trading career.

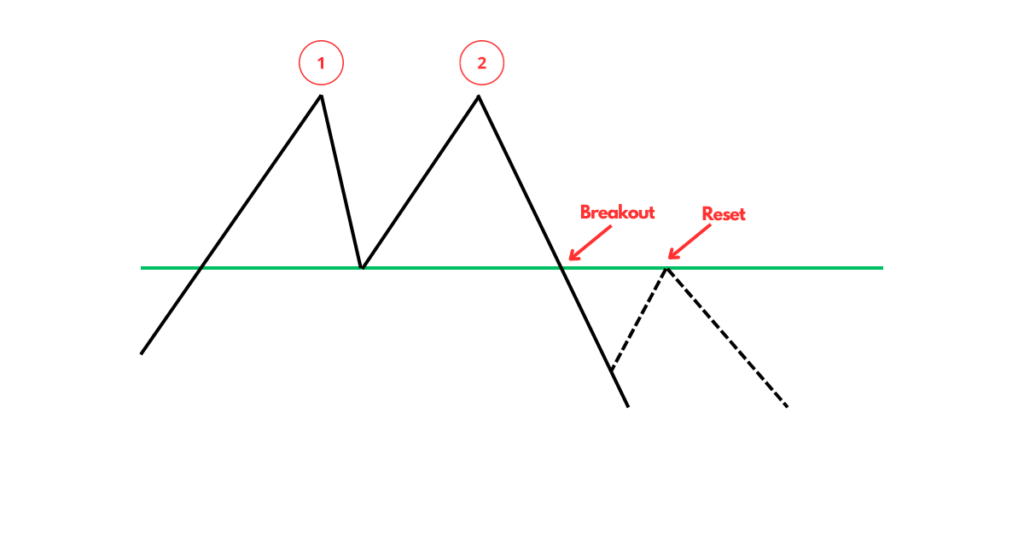

DOUBLE TOP PATTERN

A double top is an extremely bearish specialized

reversal pattern that forms after an asset

reaches a high price two successive times

with a moderate decline between the two

highs. It’s verified once the asset‘s price

falls below a support position equal to the low

between the two previous highs.

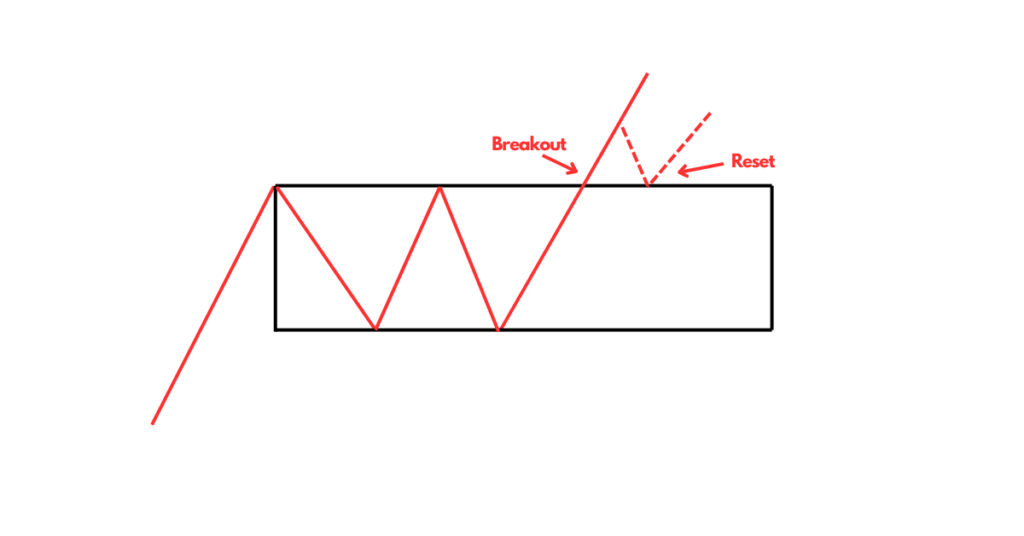

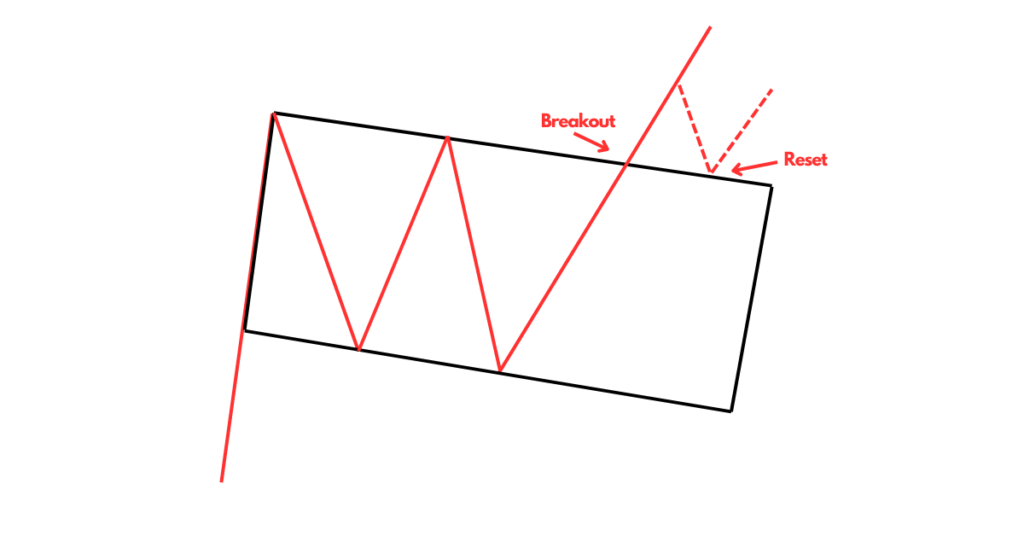

BULLISH RECTANGLE

The bullish rectangle is a continuation patterns

that occur when a price pauses during a

strong trend and temporarily bounces

between two parallel levels before the trend

continues, breakout confirmed once it break

its resistance & goes in upward direction

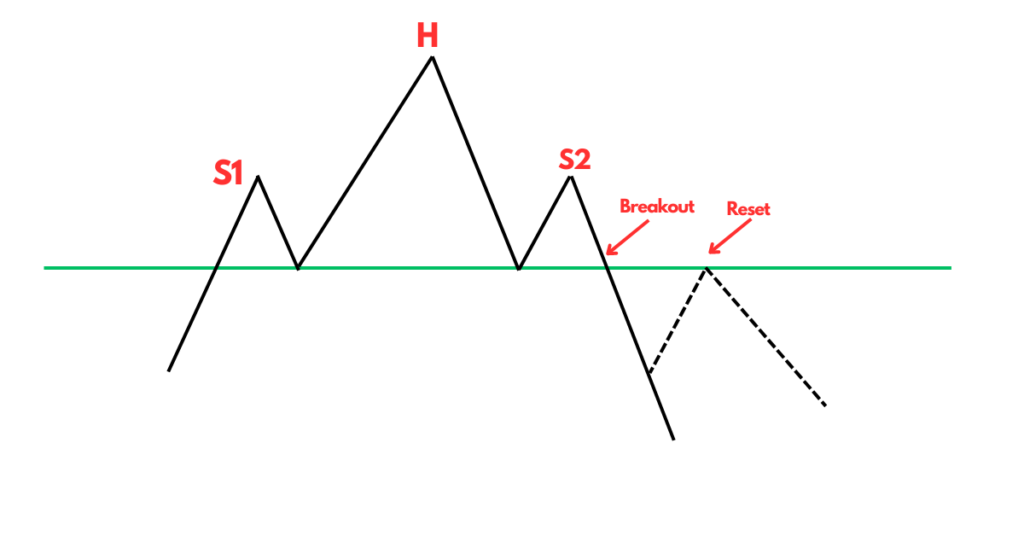

HEAD & SHOULDER PATTERN

A head & shoulder pattern is a chart formation

that appears as a baseline with three peaks,

where the outside two are similar in height and

the middle is highest & breakout confirmed

once asset breaks support level & it resembles

with human head and shoulder shape thats

why it is called as head & shoulder

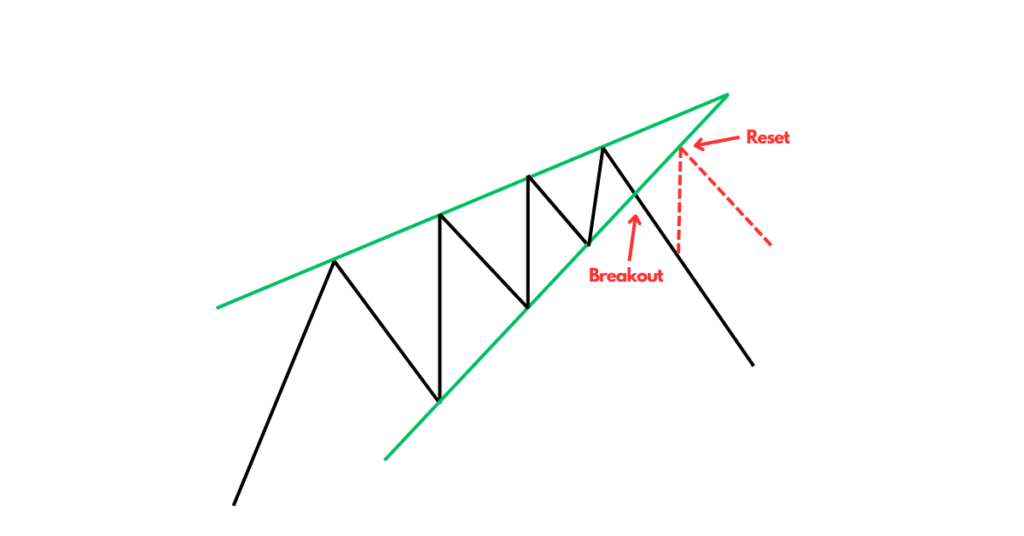

RISING WEDGE PATTERN

The rising wedge is a technical chart pattern

used to identify possible trend reversals. The

pattern appears as an upward sloping price

chart featuring two converging trendlines. It is

usually accompanied by decreasing trading

volume breakout confirmed once it break

support trendline goes downward

BULLISH FLAG PATTERN

The bullish flag formations are found in stocks

with strong up trends and considered good

continuation patterns. They are called bull

flags because the pattern resembles a flag on

a pole. The pole is the result of a vertical rise in

a chart & the flag results from a period of

consolidation, breakout confirmed once it

breaks from upperside of flag

FAQs

Referral links:

- https://blogverce.com/

- https://www.ig.com/en/trading-strategies/10-chart-patterns-every-trader-needs-to-know-190514

- https://tradeciety.com/chart-pattern-mastery-how-to-trade-chart-patterns-step-by-step

- https://fbs.com/analytics/tips/top-3-patterns-for-a-master-trader-27258

- https://www.investopedia.com/articles/technical/112601.asp

- https://www.pinterest.com/pin/master-chart-pattern-trading-in-2023–580823683213906311/